MediaTek

Corporate Governance

Corporate Governance

MediaTek strictly follows the six core values: Integrity, Conviction Inspired by Deep Thinking, Customer Focus, Constant Renewal, Innovation and Inclusiveness.

Principles of MediaTek’s

Corporate Governance

System

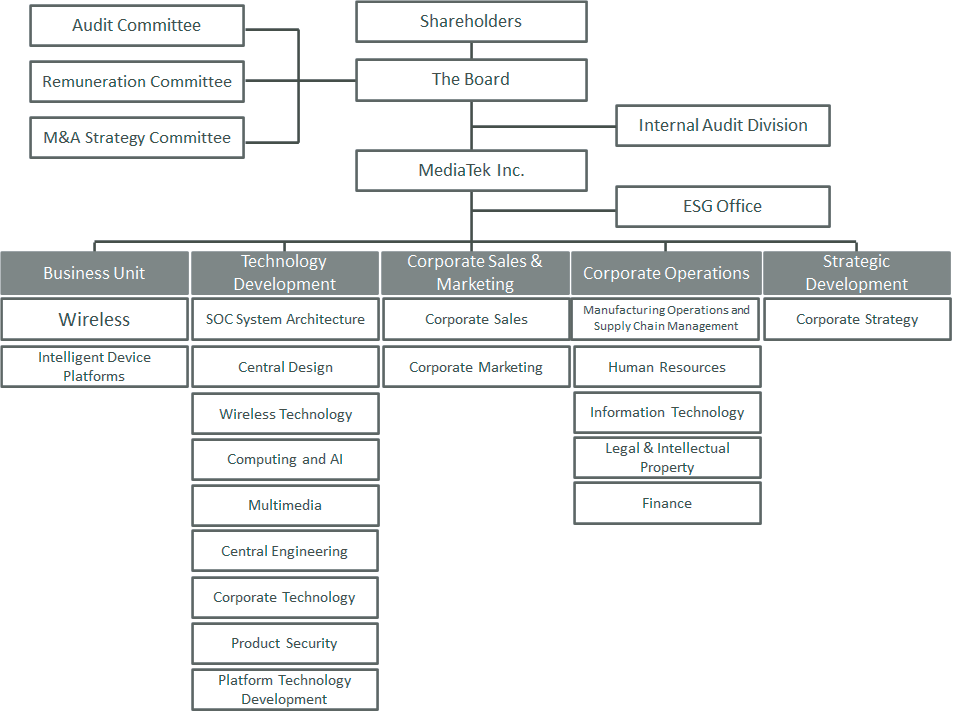

We have set up various internal guidelines to consistently keep the Company on the right path and fulfilling business goals, as well as the Company’s vision. Also, MediaTek fully values the importance of effective corporate governance and has established a corporate governance system in accordance with relevant Taiwanese laws.

The MediaTek board delegates various responsibilities and authority to three Board Committees, Audit Committee, Remuneration Committee and M&A Strategy Committee to supervise the Company effectively. The principle of MediaTek corporate governance is to protect shareholders’ rights and enhance the functional efficiency of the Board, Audit Committee and Remuneration Committee. It is also the Company’s goal to establish a comprehensive information disclosure system to fairly disclose correct and timely relevant information on its website as well as MOPs (Market Observation Post System) to ensure shareholders can access the Company’s latest information.

The Company’s Board of Directors resolved to appoint General Counsel David Su as the supervisor for corporate governance and the Legal & Intellectual Property Department under the General Counsel as the department responsible in March 22, 2019 for corporate governance and business integrity, to safeguard shareholder rights and strengthen the Board’s functioning. The General Counsel is an officer of the Company and a qualified attorney with over 3 years of experience in managing legal matters of a publicly traded company. Primary duties are to handle related matters according to law and make meeting minutes for board of director meetings and shareholder meetings, assist in the matters of director appointment and profession enhancement, provide directors with related information required in conducting business, assist directors in compliance with laws, report to the Board of Directors of its examination results as to whether the qualifications of independent directors conform to applicable laws and regulations, and other matters described in applicable laws and regulations.

Implementation in 2024:

- Conducted matters relating to Board Meetings and Shareholder Meetings

- Recorded minutes of Board Meetings and Shareholder Meetings

- Assisted in the matters of director appointment and profession enhancement

- Provided directors with related information required in conducting business

- Assist directors in compliance with laws

- Report to the Board of Directors of its examination results as to whether the qualifications of independent directors conform to applicable laws and regulations

- Handle matters relating to company registration and change of company registration

- Regularly conduct performance evaluation pursuant to the rules for “Board of Directors Self-Assessment of Performance”

Board Structure

Board of Directors

Board of Directors

To achieve good corporate governance, the main duties of MediaTek’s Board of Directors are including:

- Stipulating an effective and appropriate internal control system

- Selecting and supervising senior management

- Reviewing the company’s management policies and business plan

- Reviewing the company’s financial goals

- Supervising and handling any risks the company encounters

- Ensuring the company complies with relevant laws and regulations

- Planning the company’s future development

- Creating and maintaining the company’s image

- Ensuring the company meets its social obligations

- Appointing certified public accountants

Biographies

| Title | Name | Date Elected | Selected Education & Past Positions |

| Chairman | Ming-Kai Tsai | May 27, 2024 | - Master, Electrical Engineering, University of Cincinnati, USA - President of the 2nd Business Group, UMC |

| Vice Chairman & CEO | Lih-Shyng Tsai | May 27, 2024 | - Ph.D., Material Science and Engineering, Cornell University - Chairman and CEO, Chunghwa Telecom Co., Ltd. - President and CEO, TSMC |

| Director & President & COO | Joe Chen | May 27, 2024 | - Master, Electrical Engineering, National Chiao Tung University - Engineers of Silicon Integrated Systems Corp. |

| Director | Cheng-Yaw Sun | May 27, 2024 | - B.S., Chung Yuan Christian University of Taiwan - Managing Director, HP China |

| Independent Director | Chung-Yu Wu | May 27, 2024 | - Ph.D., Electronics Engineering, National Chiao Tung University - President, National Chiao Tung University |

| Independent Director | Peng-Heng Chang | May 27, 2024 | - Ph.D., Materials Engineering, Purdue University - VP, Human Resources / Materials Management & Risk Management, TSMC - Chairman, Motech Industries, Inc. |

| Independent Director | Syaru Shirley Lin | May 27, 2024 | - Ph.D., Politics and Public Administration, University of Hong Kong - Managing Director, Partner, Goldman Sachs & Co |

| Independent Director | Yao-Wen Chang | May 27, 2024 | - Ph.D., Department of Computer Sciences, The University of Texas at Austin, USA - IEEE CEDA President - ACM Fellow/IEEE Fellow |

Diversification policy for the composition of our Board members

The Company has a diversification policy for the board of directors. According to this policy, the composition of the Company’s board of directors should be diversified. Based on the Company’s operations, business models and development needs, the selection of members with diverse backgrounds and perspectives includes, but it is not limited to, gender, age, nationality, culture, educational background, professional background (such as law, accounting, industry, finance, marketing, or technology), professional skills, and industry experience.

In addition, the factors considered for the nomination of board members include that director candidates should have a reputation for integrity, outstanding achievements, experience, and reputation in various professional fields. They should also commit to investing sufficient time to participate in the supervision of the Company’s business, possess the ability to assist in operations and management, and contribute to the Company’s success. In the case of independent directors, their qualifications shall meet the requirements of laws and regulations.

The current board of directors of the Company consists of eight directors, including four independent directors (50%) and three directors employed by the Company (37.5%). Regarding the age of directors, there is one director aged between 51 and 55, two aged between 56 and 60, one aged between 66 and 70, and four aged between 71 and 75. Members of the board of directors have relevant professional backgrounds in science and technology and finance. Their industry experiences cover various fields in the semiconductor industry, including upstream wafer foundry (including Director Lih-Shyng Tsai, and Independent Director Peng-Heng Chang), IC design engaged by the Company (including Director Ming-Kai Tsai, Director Joe Chen, and Independent Director Chung-Yu Wu), electronic design automation (EDA, Independent Director Yao-Wen Chang), downstream end product applications (Director Cheng-Yaw Sun), and finance (Independent Director Syaru Shirley Lin).

In addition, to achieve diversity in the background, experience and expertise of the board of directors for diverse perspectives, the board of directors of the Company should include at least one director with academic background, at least one director with accounting or financial expertise, and at least one director with business management experience. Currently, three of the eight directors have been working in the academic community for a long time (including Professor Emeritus Chung-Yu Wu of NYCU, Research Professor Syaru Shirley Lin of UVA, and Distinguished Professor Yao-Wen Chang of NTU), five directors have financial experiences (including Director Ming-Kai Tsai, Director Lih-Shyng Tsai, Director Joe Chen, Independent Director Peng-Heng Chang, and Independent Director Syaru Shirley Lin), and six directors have business management experience (including Director Ming-Kai Tsai, Director Lih-Shyng Tsai, Director Joe Chen, Director Cheng-Yaw Sun, Independent Director Peng-Heng Chang, Independent Director Syaru Shirley Lin). The Company has achieved its goal of constructing a diverse board. The diversity of industry experiences and professional competencies of the board of directors are as follows:

Audit Commitee

Audit Commitee

MediaTek’s Audit Committee assists the Board in fulfilling its oversight of the quality and integrity of the accounting, auditing, reporting, and financial control practices of the Company.

The Audit Committee is responsible to review the Company’s:

- The effectiveness of company internal control process

- Auditing and accounting policies and procedures

- Potential conflicts of interests involving directors

- Material asset or derivatives transactions

- Material lending funds, endorsements or guarantees

- Offering or issuance of any equity-type securities

- Hiring or dismissal of an attesting CPA, or the compensation given thereto

- Appointment or discharge of financial, accounting, or internal auditing officers

- Financial reports

- Supervision of risk management

Audit Committee Membership

| Title | Name | Date Elected |

| Independent Director (Chairman) | Chung-Yu Wu | May 27, 2024 |

| Independent Director | Peng-Heng Chang | May 27, 2024 |

| Independent Director | Syaru Shirley Lin | May 27, 2024 |

| Independent Director | Yao-Wen Chang | May 27, 2024 |

Audit Committee Meeting

The Audit Committee held 5 sessions in 2023. The attendance of the independent directors is shown in the following table:

| Title/Name | Attendance in Person | By Proxy | Attendance Rate in Person (%) | Note |

| Independent Director: Chung-Yu Wu(Chairman) | 5 | 0 | 100% | Re-elected in the Annual General Meeting on July 5, 2021 |

| Independent Director: Peng-Heng Chang | 5 | 0 | 100% | As above |

| Independent Director: Ming-Je Tang | 5 | 0 | 100% | As above |

| Independent Director: Syaru Shirley Lin | 2 | 0 | 100% | Newly-elected in the Annual General Meeting on May 31, 2023 |

Resolutions related to Securities and Exchange Act §14-5 in 2023:

| Date | Meeting | Resolution | Any Independent Director Having a Dissenting Opinion or Qualified Opinion |

| Feb 2, 2023 | The 11th meeting of the 3rd Committee |

|

Members in the Audit Committee approved all resolutions unanimously. The Board of Directors approved all resolutions in accordance with the suggestion of the Audit Committee. |

| Feb 24, 2023 | The 12th meeting of the 3rd Committee |

|

Members in the Audit Committee approved all resolutions unanimously. The Board of Directors approved all resolutions in accordance with the suggestion of the Audit Committee. |

| Apr 27, 2023 | The 13th meeting of the 3rd Committee |

|

Members in the Audit Committee approved all resolutions unanimously. The Board of Directors approved all resolutions in accordance with the suggestion of the Audit Committee. |

| Jul 27, 2023 | The 14th meeting of the 3rd Committee |

|

Members in the Audit Committee approved all resolutions unanimously. The Board of Directors approved all resolutions in accordance with the suggestion of the Audit Committee. |

| Oct 26, 2023 | The 15th meeting of the 3rd Committee |

|

Members in the Audit Committee approved all resolutions unanimously. The Board of Directors approved all resolutions in accordance with the suggestion of the Audit Committee. |

The independent directors communicate with the chief of internal audit executive (CAE) and the independent auditor at the regular Audit Committee meetings and in the separate meetings. The communication channels and interactions are functioned well.

The CAE reports the annual audit plan execution and audit finding improvement status to independent directors at least 4 times per year and the CAE reports material audit business updates to independent directors in the quarterly separate meetings. They also exchange their opinions for the effectiveness of internal control implementation of the Company.

the independent auditor and the independent directors meet at the Audit Committee meetings at least twice per year and additionally for a separate meeting at least once per year for review and assess financial statements and discuss relevant topics or to exchange their opinions.

For special or significant matters, the independent directors can access the CAE or independent auditor for discussion anytime.

Summary of the meeting agenda that was communicated between the independent directors and CAE is shown in the following table:

| Date | Meeting | Meeting Agenda | Independent Director's Comment |

|---|---|---|---|

| 2018.03.22 | Audit Committee | 1. Status update of 2017 Q4 audit plan execution and audit findings improvement 2. Review 2017 Internal Control Self-assessment result and the Statement of Internal Control System |

None |

| 2018.04.26 | Audit Committee | 1. Status update for 2018 Q1 audit plan execution and audit findings improvement | None |

| 2018.07.30 | Audit Committee | 1. Status update for 2018 Q2 audit plan execution and audit findings improvement | None |

| 2018.10.30 | Audit Committee | 1. Status update of 2018 Q3 audit plan execution and audit findings improvement 2. Approve 2019 internal audit plan |

None |

| 2019.01.29 | Audit Committee | 1. Status update of 2018 Q4 audit plan execution and audit findings improvement | None |

| 2019.03.21 | Audit Committee | 1. Review 2018 Internal Control Self-assessment result and the Statement of Internal Control System | None |

| 2019.04.29 | Audit Committee | 1. Status update for 2019 Q1 audit plan execution and audit findings improvement | None |

| 2019.07.30 | Audit Committee | 1. Status update for 2019 Q2 audit plan execution and audit findings improvement | None |

| 2019.10.29 | Audit Committee | 1. Status update of 2019 Q3 audit plan execution and audit findings improvement 2. Approve 2020 internal audit plan |

None |

| 2020.02.06 | Audit Committee | 1. Status update of 2019 Q4 audit plan execution and audit findings improvement | None |

| 2020.03.19 | Audit Committee | 1. Review 2019 Internal Control Self-assessment result and the Statement of Internal Control System | None |

| 2020.04.17 | Audit Committee | 1. Status update for 2020 Q1 audit plan execution and audit findings improvement | None |

| 2020.07.30 | Audit Committee | 1. Status update for 2020 Q2 audit plan execution and audit findings improvement | None |

| 2020.10.29 | Audit Committee | 1. Status update of 2020 Q3 audit plan execution and audit findings improvement 2. Approve 2021 internal audit plan |

None |

| 2021.01.21 | Meeting (separate meeting) | 1. Status update of 2020 Q4 audit plan execution 2. Key audit scope of 2021 Q1 audit plan |

None |

| 2021.01.26 | Audit Committee | 1. Status update of 2020 Q4 audit plan execution and audit findings improvement | None |

| 2021.03.16 | Meeting (separate meeting) | 1.Review 2020 Internal Control Self-assessment execution status | None |

| 2021.03.18 | Audit Committee | 1. Review 2020 Internal Control Self-assessment result and the Statement of Internal Control System | None |

| 2021.04.22 | Meeting (separate meeting) | 1. Status update of 2021 Q1 audit plan execution 2. Key audit scope of 2021 Q2 audit plan |

None |

| 2021.04.27 | Audit Committee | 1. Status update for 2021 Q1 audit plan execution and audit findings improvement | None |

| 2021.07.22 | Meeting (separate meeting) | 1. Status update of 2021 Q2 audit plan execution 2. Key audit scope of 2021 Q3 audit plan |

None |

| 2021.07.26 | Audit Committee | 1. Status update for 2021 Q2 audit plan execution and audit findings improvement | None |

| 2021.10.22 | Meeting (separate meeting) | 1. Status update of 2021 Q3 audit plan execution 2. Key audit scope of 2021 Q4 audit plan |

None |

| 2021.10.25 | Audit Committee | 1. Status update of 2021 Q3 audit plan execution and audit findings improvement 2. Approve 2022 internal audit plan |

None |

| 2022.01.25 | Meeting (separate meeting) | 1. Status update of 2021 Q4 audit plan execution 2. Key audit scope of 2022 Q1 audit plan |

None |

| 2022.01.26 | Audit Committee | 1. Status update of 2021 Q4 audit plan execution and audit findings improvement | None |

| 2022.02.22 | Meeting (separate meeting) | 1.Review 2021 Internal Control Self-assessment execution status | None |

| 2022.02.25 | Audit Committee | 1. Review 2021 Internal Control Self-assessment result and the Statement of Internal Control System | None |

| 2022.04.25 | Meeting (separate meeting) | 1. Status update of 2022 Q1 audit plan execution 2. Key audit scope of 2022 Q2 audit plan |

None |

| 2022.04.26 | Audit Committee | 1. Status update for 2022 Q1 audit plan execution and audit findings improvement | None |

| 2022.07.26 | Meeting (separate meeting) | 1. Status update of 2022 Q2 audit plan execution 2. Key audit scope of 2022 Q3 audit plan |

None |

| 2022.07.28 | Audit Committee | 1. Status update for 2022 Q2 audit plan execution and audit findings improvement | None |

| 2022.10.24 | Meeting (separate meeting) | 1. Status update of 2022 Q3 audit plan execution 2. Key audit scope of 2022 Q4 audit plan |

None |

| 2022.10.27 | Audit Committee | 1. Status update of 2022 Q3 audit plan execution and audit findings improvement 2. Approve 2023 internal audit plan |

None |

| 2023.01.30 | Meeting (separate meeting) | 1. Status update of 2022 Q4 audit plan execution 2. Key audit scope of 2023 Q1 audit plan |

None |

| 2023.02.02 | Audit Committee | 1. Status update of 2022 Q4 audit plan execution and audit findings improvement | None |

| 2023.02.20 | Meeting (separate meeting) | 1. Review 2022 Internal Control Self-assessment execution status | None |

| 2023.02.24 | Audit Committee | 1. Review 2022 Internal Control Self-assessment result and the Statement of Internal Control System | None |

| 2023.04.26 | Meeting (separate meeting) | 1. Status update of 2023 Q1 audit plan execution 2. Key audit scope of 2023 Q2 audit plan |

None |

| 2023.04.27 | Audit Committee | 1. Status update for 2023 Q1 audit plan execution and audit findings improvement | None |

| 2023.07.20 | Meeting (separate meeting) | 1. Status update of 2023 Q2 audit plan execution 2. Key audit scope of 2023 Q3 audit plan |

None |

| 2023.07.27 | Audit Committee | 1. Status update for 2023 Q2 audit plan execution and audit findings improvement | None |

| 2023.10.24 | Meeting (separate meeting) | 1. Status update of 2023 Q3 audit plan execution 2. Key audit scope of 2023 Q4 audit plan 3. 2024 internal audit plan |

None |

| 2023.10.26 | Audit Committee | 1. Status update of 2023 Q3 audit plan execution and audit findings improvement 2. Approve 2024 internal audit plan |

None |

Remuneration Committee

Remuneration Committee

The Remuneration Committee assists the Board in discharging its responsibilities related to MediaTek's performance evaluation of directors and executives, the remuneration and benefit policies, rules, standards and structure, as well as the assessment of the remuneration and benefit for directors and executives.

According to MediaTek’s Remuneration Committee Charter, the members of the Remuneration Committee are appointed by the Board and the Remuneration Committee shall consist of no fewer than three members. The Company has elected independent directors as required by Taiwan (R.O.C.) law, and there should be at least one independent director sitting on the Remuneration Committee. The Remuneration Committee meets at least twice a year. Please consult MediaTek’s annual report for the relevant year for the number of meetings convened and each member’s attendance rate.

Remuneration Committee Membership

Summary of the members’ attendance is shown in the following table:

| Year | Title | Name | Attendance in Person | Attendance Rate in Person (%) |

|---|---|---|---|---|

| 2020 | Convener and Chairperson | Peng-Heng Chang | 2 | 100% |

| 2020 | Member | Chung-Yu Wu | 2 | 100% |

| 2020 | Member | Ji-Ren Lee | 2 | 100% |

| 2021 | Convener and Chairperson | Peng-Heng Chang | 3 | 100% |

| 2021 | Member | Chung-Yu Wu | 3 | 100% |

| 2021 | Member | Ji-Ren Lee | 3 | 100% |

| 2022 | Convener and Chairperson | Peng-Heng Chang | 3 | 100% |

| 2022 | Member | Chung-Yu Wu | 3 | 100% |

| 2022 | Member | Ji-Ren Lee | 3 | 100% |

| 2023 | Convener and Chairperson | Peng-Heng Chang | 2 | 100% |

| 2023 | Member | Chung-Yu Wu | 2 | 100% |

| 2023 | Member | Ji-Ren Lee | 2 | 100% |

| 2024 | Convener and Chairperson | Peng-Heng Chang | 3 | 100% |

| 2024 | Member | Chung-Yu Wu | 3 | 100% |

| 2024 | Member | Ji-Ren Lee | 3 | 100% |

Summary of the meeting agenda and result is shown in the following table:

| Date | Meeting | Meeting Agenda | Resolution |

|---|---|---|---|

| 2020.02.05 | The 4th meeting of the 4th Committee | Key managers’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2020.03.19 | The 5th meeting of the 4th Committee | Directors’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2021.01.26 | The 6th meeting of the 4th Committee | Key managers’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2021.03.18 | The 7th meeting of the 4th Committee | Directors’ remuneration and issuance of restricted stock award | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2021.08.13 | The 1st meeting of the 5th Committee | Key Managers’ stock remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2022.01.25 | The 2nd meeting of the 5th Committee | Key managers’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2022.03.15 | The 3rd meeting of the 5th Committee | Directors’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2022.07.27 | The 4th meeting of the 5th Committee | Executive officer stock ownership guideline and implementing rules、Revisit key managers’ remuneration、Directors’ remuneration structure and standard | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2023.02.01 | The 5th meeting of the 5th Committee | Key managers’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2023.02.23 | The 6th meeting of the 5th Committee | Directors’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2024.01.29 | The 6th meeting of the 5th Committee | Key managers’ remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2024.02.23 | The 7th meeting of the 5th Committee | Directors’ remuneration and issuance of restricted stock award | Approved by all attending members of the committee and all attending directors in the board of director meetings |

| 2024.07.30 | The 1st meeting of the 6th Committee | Key Managers’ stock remuneration | Approved by all attending members of the committee and all attending directors in the board of director meetings |

Executive Officer Stock Ownership Guidelines

To further align the executive officers’ interests with the long-term interests of MediaTek’s shareholders and to promote MediaTek’s commitment to sustainable development, MEDIATEK INC. EXECUTIVE OFFICER STOCK OWNERSHIP GUIDELINES have been adopted by the Board in 2022. All MediaTek executive officers shall own a certain amount of MediaTek common shares equivalent to a multiple of their annual base salary for as long as they serve as an executive officer of MediaTek. Executive officers shall meet the guidelines within three years after appointed by Board as an executive officer.

M&A Strategy Committee

M&A Strategy Committee

To enhance corporate governance and the strategic guidance function of the Board of Directors, the Mergers and Acquisitions Strategy Committee (“M&A Strategy Committee”) has been established in accordance with Article 27 of the Corporate Governance Best Practice Principles. The responsibilities of this M&A Strategy Committee include conducting strategic evaluations of the Group's mergers and acquisitions projects and reporting to the Board of Directors. To ensure the sustainable operation of the Group, in addition to discussing specific merger and acquisition projects, the overall merger and acquisition strategy of the Group is regularly reviewed in the M&A Strategy Committee. The M&A Strategy Committee examines major global industry investment cases and trends, identifies the risks and opportunities brought about by changes in the external environment, and leverages the diverse expertise of the Directors to facilitate the achievement of the Company's short, medium, and long-term goals, as well as the sustainable development goals.

The establishment of this M&A Strategy Committee will not affect the exercise of the functions and powers of the Company’s Audit Committee. Mergers and acquisitions that should be resolved by the Audit Committee in accordance with relevant laws and regulations should still be reviewed by the Audit Committee in accordance with applicable laws and regulations.

The M&A Strategy Committee consists of four directors. Currently, the members of the M&A Strategy Committee are chairman Ming-Kai Tsai, independent director Peng-Heng Chang, independent director Syaru Shirley Lin and independent director Yao-Wen Chang. Their professional competencies are listed in the following table:

M&A Strategy Committee Membership

| Name | Professional Competencies |

| Chairman Ming-Kai Tsai (Chairperson) | with expertise in management and strategic planning |

| Peng-Heng Chang (Independent Director) | with expertise in business management and organization planning |

| Syaru Shirley Lin (Independent Director) | with expertise in business/finance and strategic planning |

| Yao-Wen Chang (Independent Director) | with expertise in industry/technology and strategic planning |

Operation of M&A Strategy Committee

The committee has held one meeting in 2023 in accordance with M&A Strategy Committee Charter. All members of the committee attended the meeting with attendance rate of 100%.

Corporate Management

| Title | Name | Date on Board | Selected Education & Past Positions |

|---|---|---|---|

| Chairman | Ming-Kai Tsai | May 21, 1997 | - Master, Electrical Engineering, University of Cincinnati, USA - President of the 2nd Business Group, UMC |

| Vice Chairman & CEO | Rick Tsai | June 1, 2017 | - Ph.D., Materials Science and Engineering, Cornell University - Chairman & CEO, Chunghwa Telecom Co. Ltd. - President & CEO, TSMC |

| President & COO | Joe Chen | July 1, 2012 | - Master, Electronics Engineering, National Chiao Tung University - Engineer, SiS Corp. |

| Co-COO, Corporate Executive Vice President, CFO & Spokesman | David Ku | January 1, 2011 | - MBA, University of Illinois at Urbana Champaign - Vice President of JPMorgan Investment bank |

| Corporate Executive Vice President | Cheng-Te Chuang | April 7, 2009 | - Master, Electronics Engineering, National Chiao Tung University - Engineer, UMC |

| Corporate Executive Vice President & CTO | Kevin Jou | May 30, 2011 | - Ph.D., Electrical Engineering, University of Southern California - VP, Technology, Qualcomm and CTO, Qualcomm China |

| Corporate Sr. Vice President | Kou-Hung Loh | July 1, 2006 | - Ph.D., Electrical Engineering, Texas A&M University - CEO and founder of Silicon Bridge |

| Corporate Sr. Vice President | Jerry Yu | February 16, 2015 | - Master, Electrical Engineering, National Taiwan University - Technical Manager, Lian Ji technology Co., Ltd. |

| Corporate Sr. Vice President | Jasper Yang | June 1, 2016 | - Bachelor, Electrical Engineering, National Tsing Hua University - Shanghai Chief Representative, UMC |

| Corporate Sr. Vice President | SR Tsai | December 1, 2017 | - Master, Mechanical Engineering, National Taiwan University - Section Chief, KTC |

| Corporate Sr. Vice President | JC Hsu | August 1, 2015 | - Ph.D., Power Mechanical Engineering, National Tsing Hua University |

| Corporate Sr. Vice President & CHRO | Sherry Lin | June 1, 2016 | - Master, Industrial Relations and Human Resources (IRHR), Rutgers University - HR Director, TSMC |

| Corporate Sr. Vice President & General Counsel | David Su | November 1, 2016 | - SJD, University of Wisconsin Law School - Senior Program Director, TSMC |

| Corporate Vice President | Rolly Chang | August 1, 2015 | - Master, Communications Engineering, National Chiao Tung University - Technical Specialist, NCSIST |

| Corporate Vice President | Mike Chang | January 1, 2019 | - Ph.D., Electrical Engineering, National Tsing Hua University - Executive Vice President of MStar Semiconductor Inc. |

| Corporate Vice President | Vincent Yung Mien Hu | August 3, 2020 | - Master, Business Administration, Marketing and Entrepreneurship, Anderson Graduate School of Management at UCLA - Master, Science in Electrical Engineering, Communication Sciences, University of Southern California - Vice President, Intel Corp. |

| Corporate Vice President | Ching San Wu | November 1, 2020 | - Master, Electronics Engineering, National Chiao Tung University - Project Manager, Macronix International CO., LTD. |

| Corporate Vice President | Alan Hsu | November 1, 2020 | - Master, Control Engineering, National Chiao Tung University - Senior Engineer, Phoenixtec Power CO., LTD. |

| Corporate Vice President | Harrison Hsieh | February 1, 2024 | - Master, Computer Science & Information Engineering, National Taiwan University |

| Corporate Vice President | Eric Lon Fisher | February 1, 2024 | - Masters of Business Administration, University of California, Irvine - Senior Vice President, World Wide Sales & Applications, Acacia Communications - Vice President Sales, America's and Global Key Account, Intel Corp. |

Internal Auditing

Internal Audit Responsibilities

MediaTek has an independent Internal Audit Division that reports directly to the Board of Directors. It aims to assist the Company to achieve its objective by reviewing the adequacy, effectiveness and efficiency of the internal control system.

Regular internal audit works are executed according to the annual audit plan approved by the Board of Directors. The plan is based on the risk assessment result. Special audit works or reviews are conducted as need basis. Deficiencies identified in the internal control system and recommendations for improvements in the audit reports are regularly submitted to, and reviewed by, the Board of Directors. Any significant deviation from the approved audit plan will also communicate to senior management and the Board of Directors through the periodic activity reports.

The Internal Audit Division also examines the annual internal control self-assessment process and results from departments and subsidiaries. The consolidated self-assessment result is provided for the Board of Directors to evaluate the overall efficiency of existing internal control systems before generating an internal control statement.

Business Conduct Violation Reporting

Mediatek provides the following channels for business conduct violation reporting. Information included in such report and personal information provided by the reporting party shall be kept confidential by Mediatek subject to applicable laws.

Report by phone: (886)-3-6030011, Mediatek chief of internal audit executive (CAE)

Report by email: ethics.reporting@mediatek.com (automatically forwarded to Mediatek CAE)

Report by letter: No.1 dusing 1st Rd., Hsinchu City (Attention Mediatek CAE)